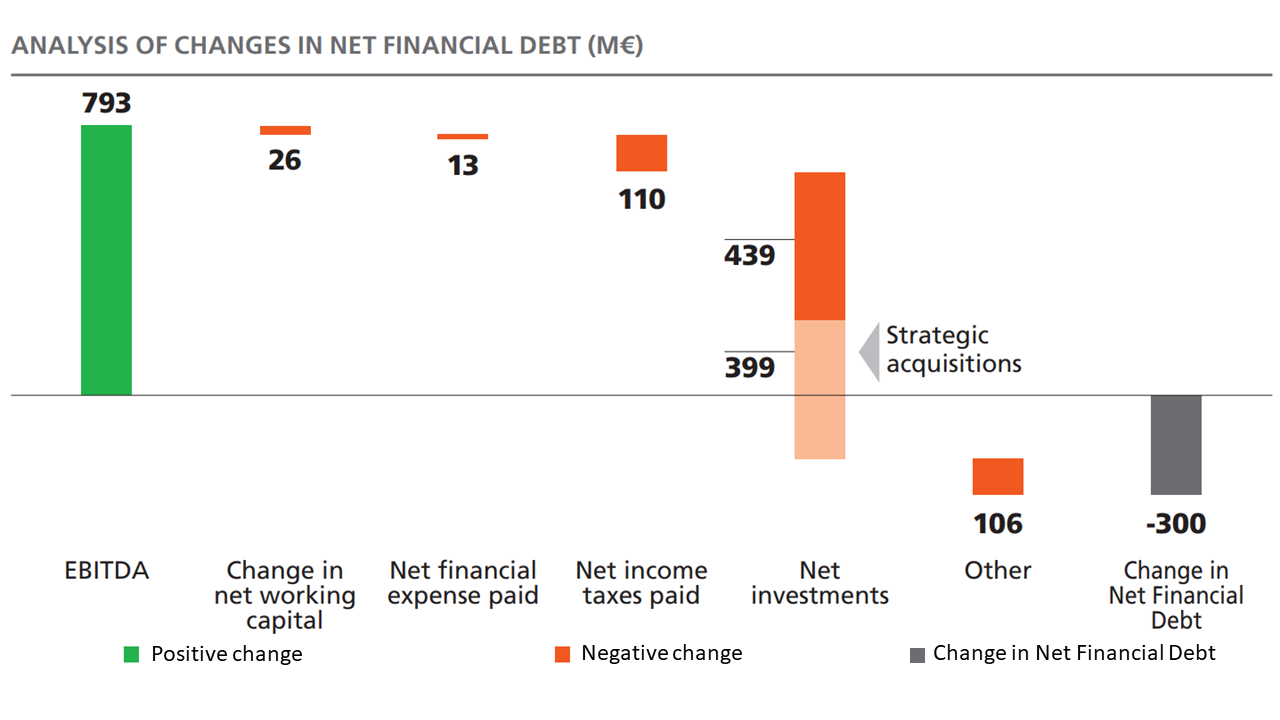

At December 31, 2018, net financial debt totaled 416 million euros, 300 million euros higher than the 116 million euros at December 31, 2017.

The change in the year reflects the acquisitions of GNVI, Attiva and Zephyro and the good cash generation of the operating activities, which cointeined the level of the net financial debt.

Currently (*), Edison is rated BBB-/A-3 stable outlook by Standard and Poor's and Baa3 positive outlook by Moody’s.

The table below provides a simplified breakdown of the variation of the Group’s net financial debt: