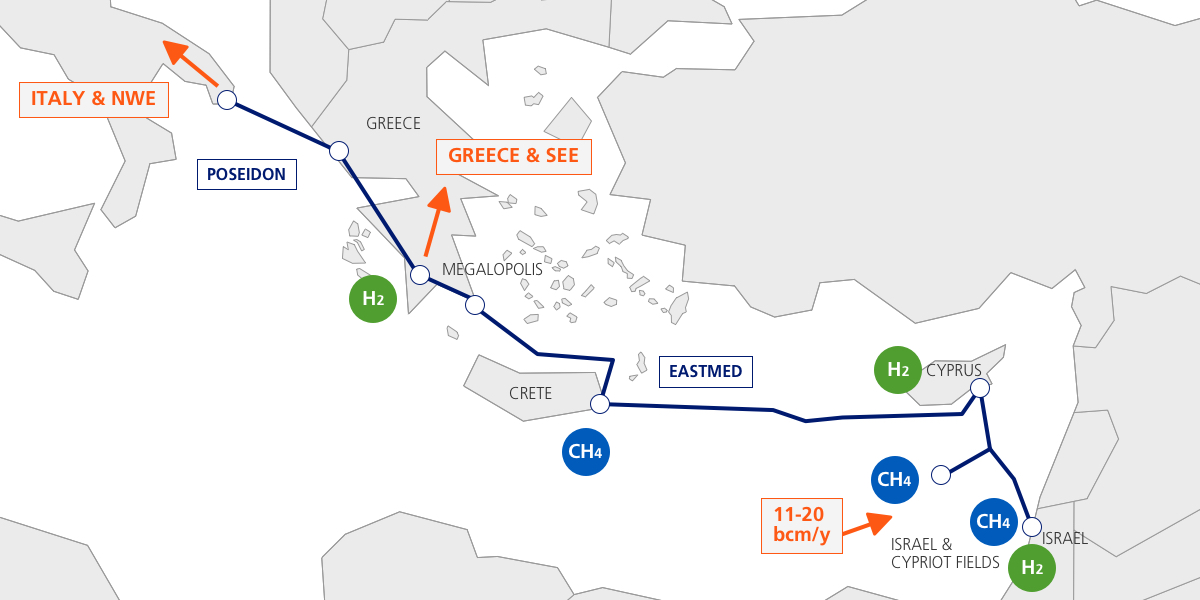

EastMed-Poseidon Pipeline: a direct interconnection between sources and markets

A European strategic project, confirmed technically feasible and economically competitive

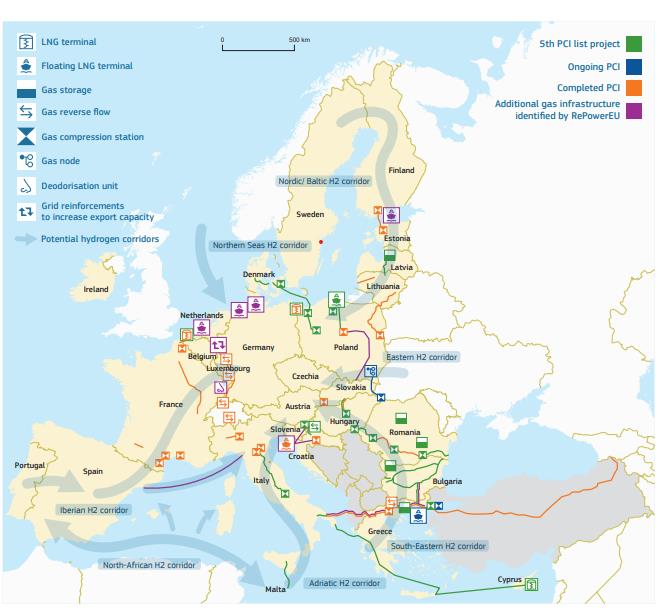

- The strategic relevance: Project of Common Interest (PCI) since 2013 and now included in the RePowerEU Plan

- The most mature project in the area: today in the final authorisation and engineering phase with completion targeted by the end of 2022. Expected commercial operation date in 2027

- A strategic route: direct connection between Europe and Israeli sources avoiding transit risks

- Coherent with the energy transition: in line with Europe's mid-term strategy, the project leads the way for offshore hydrogen transportation

The levantine gas sources will be sufficient and available in 3 years

Substantial gas volumes able to contribute effectively to the diversification of European imports

Opportunities in the area

- Israeli gas fields will increase current productions by additional 20 Bcm/year within 3 years

- The available volumes, confirmed by local E&P players, will be sufficient for the development of new export infrastructures in addition to, and not in competition with, the existing ones

- The construction of the pipeline would also facilitate the development of Cyprus' gas sources

- Italy and Greece could also guarantee availability and transportation of these volumes to Central Europe and Balkans

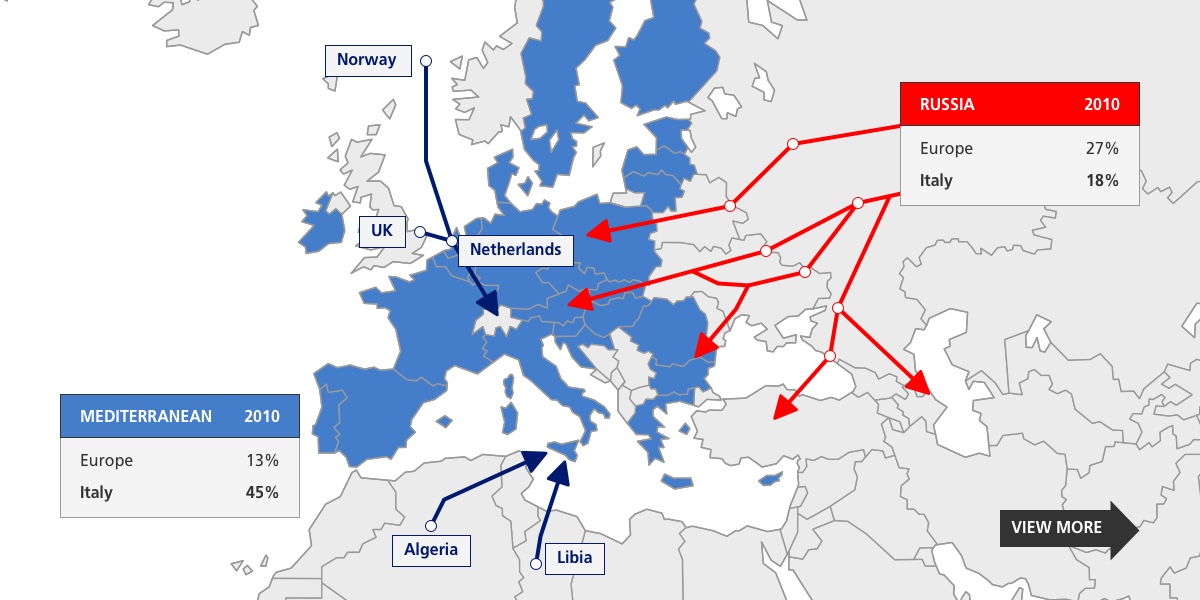

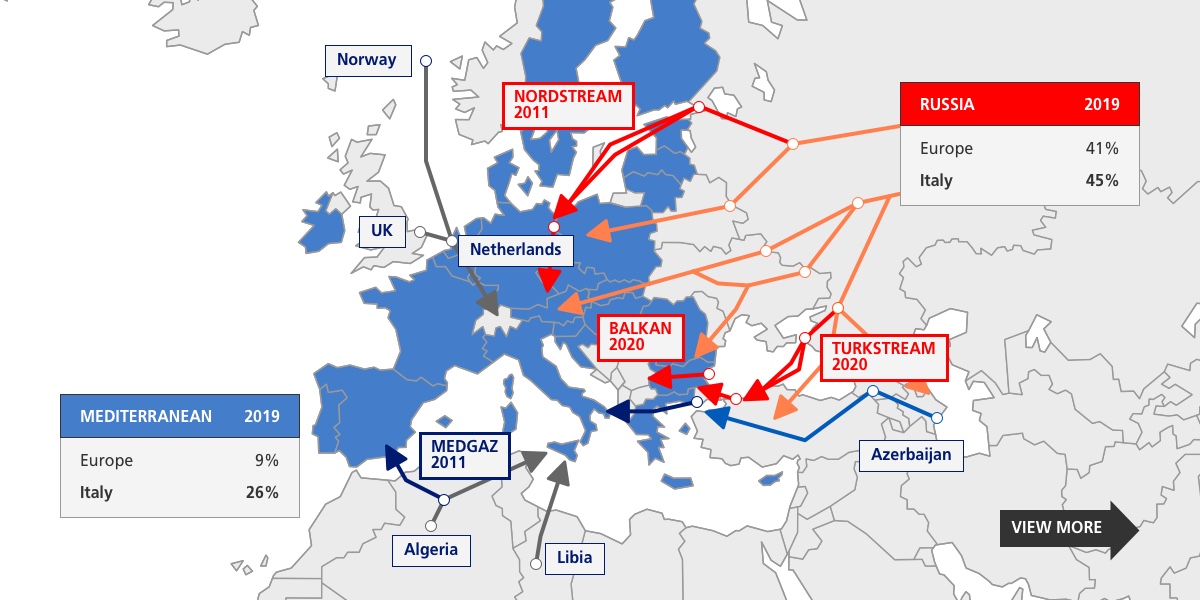

The European strategy

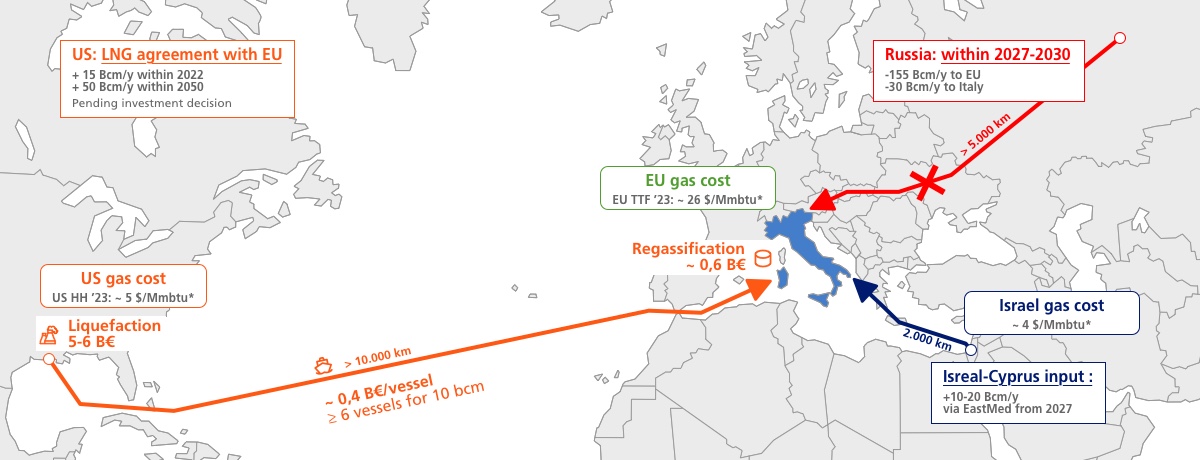

phase out from the dependence on the Russian supply system by 2027

Europe and Italy will have to replace Russian gas supplies respectively of 150 Bcm/year (33% of demand) and 30 Bcm/year (40%) and ensure system security during the whole energy transition period

- Since 2011, important interconnections with Russia have been realised for a total of ~140 bcm/year (Nordstream 1 & 2 110 bcm/y and TurkStream 32 bcm/y)

- Mediterranean area has seen, otherwise, a limited infrastructure development (TAP 10 bcm/y and MedGaz 10 bcm/y)

- The RePowerEU plan aims to establish long-term partnerships with reliable suppliers and diversify gas routes

Technical feasibility confirmed and technology in line with the state of the art

Feasibility confirmed by both leading industry companies and international certification entities

Technical challenges already faced

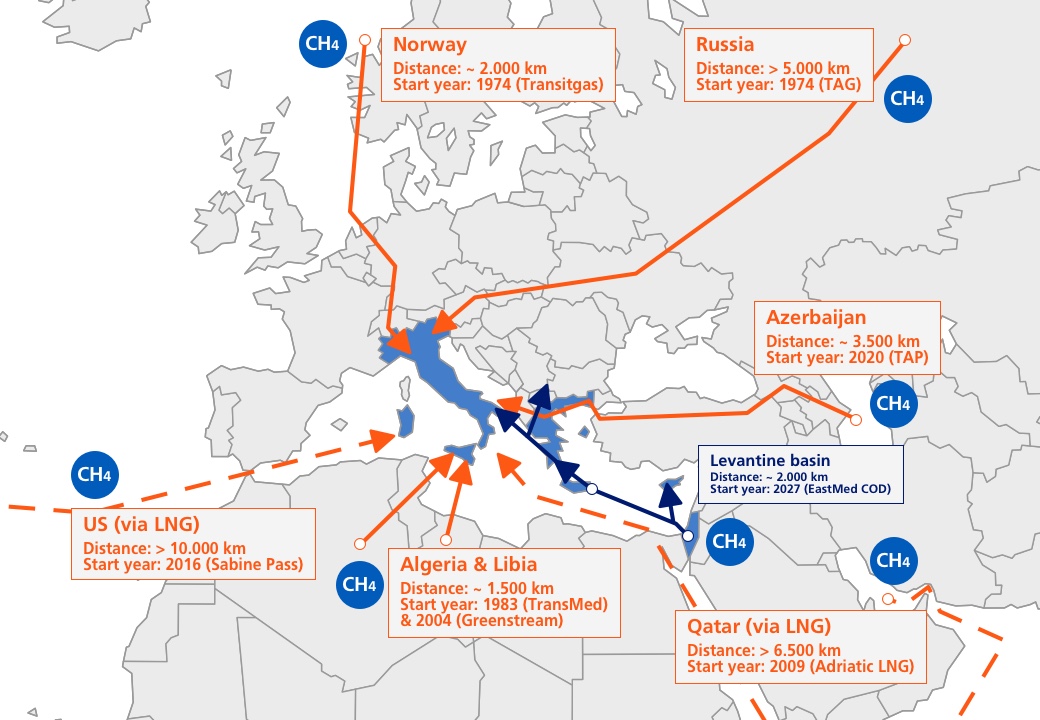

- ~2,000 km total length, shorter than the Azeri chain, comparable to the Norwegian one

- 800 km main offshore section, less than NordStream and TurkStream

- 2,200 m average depth of the main section, in line with TurkStream and Medgaz

- 3,000 m the max water depth, only for 10 km, as pipelines in operation in the Gulf of Mexico

- 18 months to lay the offshore section, in line with TurkStream

A competitive and efficient investment

The initiative is able to ensure stable long-term supplies with less exposure to global market price fluctuations

- Most efficient solution for transporting gas from the Mediterranean to European markets

- Total investment of 6 B€, lower than LNG chains with equal capacity (10 Bcm/y): liquefaction plant 5-6 B€ + regas terminal ~1 B€ + shipping

- Competitive transport tariff, optimised on distance between sources and markets, equal to 2,000 km (global LNG market > 6,000 km)

- The project could also allow connected markets to diversify price signals (compared to global LNG market)

- Financial support from the EU (as a PCI project) would further increase competitiveness.

Benefits for Europe and the Mediterranean

In the current geopolitical scenario, EastMed-Poseidon is a key project for the diversification of national and European supplies

New long-term partnerships with reliable suppliers

- EastMed-Poseidon is included in the list of Projects of Common Interest (PCI) since 2013 and has recently been confirmed in March 2022 by the European Commission

- Thanks to its PCI status, the project benefits of fast-track authorisation procedures

- The project is also part of the REPowerEU plan and will advantage from relevant financial instruments

- The cost-benefit analysis, carried out by the Association of European TSOs (ENTSOG), has repeatedly confirmed the positive impact of the project with possible reductions in the final energy prices for connected markets

EastMed-Poseidon: a unique and inclusive opportunity for the system

The project represents an option of high strategic value for European energy security

-> Europe and Italy, in addition to mitigating the short-term emergency, will have to implement medium and long-term solutions that ensure a stable substitution of Russian volumes

-> The Eastern Mediterranean today does not have infrastructures capable of exporting all the volumes available in the area

-> EastMed-Poseidon is an essential project not in competition with the LNG infrastructure in Egypt, today already exporting to global markets

-> The infrastructure is a mature and feasible project within the same timeframe as other proposed supply solutions (2027)

-> EastMed-Poseidon is designed to transport hydrogen, a key element of Europe's energy transition

-> Involved countries will benefit from a connection to close and stable gas sources, anchoring their energy markets to price signals not only dependent to global LNG dynamics